All Accounting & Auditing articles – Page 20

-

Article

ArticleWhat companies/auditors need to know for 2021 year-end audits

The continued effects of the pandemic, along with the implementation of new accounting standards, have companies and their auditors confronting substantial change in year-end audits.

-

Article

ArticleFRC closes Conviviality accountant investigation; KPMG probe continues

The U.K. Financial Reporting Council announced the end of an investigation into an accountant that prepared and approved financial statements at collapsed alcohol retailer Conviviality.

-

Article

ArticleEx-Roadrunner CFO gets two years in prison for accounting fraud scheme

Peter Armbruster, the former chief financial officer of trucking and logistics company Roadrunner Transportation Systems, was sentenced to 24 months in prison for his role in a complex securities and accounting fraud scheme.

-

Article

ArticleSequential Brands avoids fine in SEC goodwill impairment case

Sequential Brands won’t be fined as part of a settlement with the SEC over charges it violated accounting principles in securities law when it did not acknowledge goodwill impairment that eventually landed on its balance sheet as a $304 million write-down.

-

Article

ArticleSEC updates guidance on ‘spring-loaded’ compensation awards

The Securities and Exchange Commission released new guidance for listed companies on how to properly recognize and disclose compensation costs for “spring-loaded” awards made to executives.

-

Article

ArticleFASB proposes CECL disclosure updates

The Financial Accounting Standards Board announced a proposed update aimed to enhance disclosures regarding troubled debt restructuring and gross writeoffs under its credit losses standard.

-

Article

ArticleProPetro avoids fine in executive perk case; ex-CEO to pay $195K

The former CEO of ProPetro Holding Corp. will pay $195,046 to settle SEC charges related to the company’s failure to disclose some of his executive perks and stock pledges to investors. ProPetro avoided a fine because of its remedial efforts.

-

Article

ArticleFRC report sets quality expectations for U.K. audit firms

The U.K. Financial Reporting Council published a blueprint for how it wants audit firms to perform to ensure they deliver high-quality audits.

-

Article

ArticleFASB update improves discount rate guidance under leases standard

The Financial Accounting Standards Board issued an update to its leases standard regarding discount rate guidance for lessees that are not public business entities.

-

Article

ArticleFASB update provides expedient for valuing share-based awards

The Financial Accounting Standards Board has provided a practical expedient for private companies to reduce the complexity of determining the fair value of share-based awards.

-

Article

ArticleFASB passes on third leases delay

The Financial Accounting Standards Board declined providing private companies and certain not-for-profit organizations a third date delay to its leases standard, which is scheduled to take effect fiscal years beginning after Dec. 15, 2021.

-

Article

FASB proposes amendments to interim disclosure requirements

The Financial Accounting Standards Board proposed an update to its interim reporting standard as part of its disclosure framework project aimed at improving the clarity, consistency, and effectiveness of financial statement disclosures.

-

Article

ArticleSEC appoints 4 to overhauled PCAOB; Erica Williams named chair

The SEC appointed Erica Williams to serve as chairperson of the newly overhauled PCAOB. Kara Stein, Christina Ho, and Anthony Thompson will join as new additions, while Acting Chair Duane DesParte will remain on as a board member.

-

Article

ArticleSEC approves rule establishing process for delisting foreign companies

The SEC approved a rule establishing the process for delisting foreign companies from U.S-based exchanges if they do not allow U.S. regulators to examine their finances.

-

Article

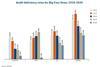

ArticlePCAOB 2020 inspection reports: PwC bucks deficiency trend, dethrones Deloitte

PwC ended its three-year run of increasing deficiency percentages to boast the lowest rate among Big Four firms in the PCAOB’s 2020 inspection reports—the first time Deloitte hasn’t performed best since 2016.

-

Article

ArticleGrant Thornton UK fined for ‘skepticism failures’ in Interserve audit

Grant Thornton UK received a “severe reprimand” and reduced penalty of £718,250 (U.S. $981,000) for breaches that arose in the context of audit work on the 2015-17 financial statements of now-collapsed construction firm Interserve.

-

Article

ArticleFASB update addresses revenue recognition in business combinations

The Financial Accounting Standards Board announced an update to its business combinations standard aimed at clarifying how to apply requirements under its revenue recognition rule.

-

Article

SEC: Akazoo to pay $38.8M in fraud case concerning SPAC merger

Akazoo, a music streaming subscription company based in Greece, reached a $38.8 million settlement with the SEC for allegedly defrauding investors out of tens of millions of dollars related to a 2019 SPAC merger.

-

Article

ArticleFRC reporting review: COVID-19 disclosures lacking, new climate-related mandates

In its annual review of corporate reporting, the U.K. Financial Reporting Council found companies are struggling to provide stakeholders with enough detail about COVID-19 disruptions. The regulator also announced new requirements for climate-related disclosures.

-

Article

ArticleEY report: Fortune 100 companies boost audit transparency, including on ESG

Many Fortune 100 companies continue to enhance their transparency about how their audit committees are executing their core responsibilities, according to the EY Center for Board Matters’ 10th annual review of voluntary proxy statement disclosures.