Premium Content | Compliance Week – Page 30

-

Premium

PremiumWyelands Bank case warrants extra scrutiny post-SVB collapse

The details of the Prudential Regulation Authority’s case against Wyelands Bank and the business coming from the group of companies that owned it raise questions about the risks such exposure causes to financial institutions, their customers, and the sector at large.

-

Premium

PremiumHow to avoid pitfalls of scaling business with generative AI

Generative AI has the potential to be as game-changing for business and society as the internet, social media, and mobile phones were. At the moment, however, the risks seem to outweigh the rewards.

-

Premium

PremiumAs final CPRA rules trickle out, a reminder companies must ‘grow with the law’

If companies haven’t started the process of coming into compliance with the California’s sweeping new privacy law, they need to begin now.

-

Premium

PremiumNeed to know: FASB proposal on accounting for crypto assets

The Financial Accounting Standards Board issued a proposed accounting standards update to improve accounting and disclosures for certain crypto assets.

-

Premium

Premium‘An unexpected stress test’: European banks weathering storm of U.S. failures

Except for Credit Suisse’s demise, Europe has so far largely patted itself on the back for preventing further contagion in the banking sector following the failures of Silicon Valley Bank, Silvergate Bank, and Signature Bank in the United States.

-

Premium

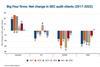

PremiumAudit client turnover 2022: Deloitte gains among Big Four, Marcum biggest winner

Deloitte was the only Big Four audit firm to net positive in new public company clients in 2022, while Marcum saw the largest overall gains a year removed from losing 110 clients, according to the latest annual study.

-

Premium

PremiumNAVEX: Record whistleblower report totals suggest ‘more cautious workforce’

More whistleblowers than ever before filed reports with their employers in 2022, with more than half doing so anonymously, according to the latest hotline benchmark report from NAVEX.

-

Premium

PremiumLeadership, resource support key to compliance navigating bank turmoil

In sudden bank buyouts, the workload on compliance departments skyrockets as new customers are nearly instantly assumed by the purchasing bank. Experts share their take on managing the resulting risks.

-

Premium

PremiumSurvey: Tech key to compliance in changing data privacy landscape

Respondents to a survey from Compliance Week and Exterro largely said they were confident their organizations are meeting regulatory requirements regarding data privacy despite evidence their data retention policies and procedures are outdated.

-

Premium

PremiumBest practices to ensure your firm’s compliance resiliency

What is compliance resiliency, and why is it crucial for your organization to have it? Recent enforcement examples demonstrate why mapping out a clear business continuity plan can help thwart a risky management reshuffle.

-

Premium

PremiumExperts: Fraud risks heightened amid banking turmoil

The stunning, rapid collapse of Silicon Valley Bank, fueled in its final days by droves of panicked depositors seeking funds, likely added to the chaos within the bank and ratcheted up the risk of fraud, according to legal experts.

-

Premium

PremiumWhere will regulators turn following SVB, Signature Bank failures?

Small and mid-sized banks can expect more regulatory scrutiny in the aftermath of the collapses of Silicon Valley Bank and Signature Bank, according to legal experts. The time to prepare is now.

-

Premium

PremiumTRACE enforcement report highlights anti-bribery trends from 2022

The United States broke from a three-year downturn in bribery-related enforcement actions, while Brazil continued its emergence in the space, according to the results of the latest annual Global Enforcement Report by nonprofit TRACE.

-

Premium

PremiumExperts: DOJ clawback pilot to be ‘work in progress’

Businesses and compliance professionals should expect the Department of Justice’s new compensation clawback policies to be applied on a case-by-case basis, with broad discretion, according to legal experts.

-

Premium

PremiumAccounting and reporting challenges of environmental credits

Companies are working on plans to reduce their carbon emissions. The popularity of environmental credits has grown as a way for companies to meet their emission reduction targets.

-

Premium

PremiumRegulators on damage control following SVB, Signature Bank failures

The White House, Department of the Treasury, and other federal banking regulators swung into action over the weekend to prevent the failure of two banks with $264 billion in combined deposits from turning into a full-blown economic crisis.

-

Premium

PremiumExperts: Delaware court McDonald’s ruling lowers bar on officer liability

The fiduciary duty of oversight that historically has applied only to directors “applies equally to officers,” including CCOs, the Delaware Court of Chancery explicitly held in its ruling regarding former McDonald’s Chief People Officer David Fairhurst.

-

Premium

PremiumU.K. push for GDPR reprimand transparency draws mixed reviews

The U.K. Information Commissioner’s Office began publishing the details of cases where organizations breached the General Data Protection Regulation but were not fined. Legal experts share their take on the initiative.

-

Premium

PremiumGoogle, Uber CCOs share approaches to data analytics

The chief compliance officers of Google and Uber offer insight into how their data analytics compliance programs have evolved amid enhanced scrutiny on use of technology from the Department of Justice.

-

Premium

PremiumAsk a CCO: What matters most in federal privacy law?

Four senior compliance practitioners provide their opinions on what a federal privacy law in the United States should strive to accomplish.