All Accounting & Auditing articles – Page 13

-

Article

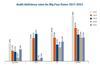

ArticlePCAOB 2021 inspection reports: PwC sees best results again; EY deficiencies increase

For the second straight year, PwC fared the best among inspection results released by the Public Company Accounting Oversight Board for the largest U.S. audit firms, including each of the Big Four, Grant Thornton, and BDO.

-

Article

Exela Technologies, ex-CFO settle SEC control failure charges

Texas-based IT firm Exela Technologies and its former CFO settled charges brought by the Securities and Exchange Commission alleging failure to properly account for and record liabilities related to a shareholder lawsuit.

-

Article

ArticlePCAOB announces ‘complete access’ to audit papers of Chinese firms

The Public Company Accounting Oversight Board announced it received “complete access to inspect and investigate” audit firms in China and Hong Kong, potentially averting the delisting of hundreds of Chinese public companies from U.S. exchanges.

-

Article

ArticleESG oversight highlighted in annual audit committee transparency report

Public companies continue to increase the overall level of audit committee disclosures in proxy statements, though there is room to improve quality by providing more tailored disclosures and transparency, according to the latest annual report.

-

Article

ArticleChallenges for SPACs: Public company, now what?

Special purpose acquisition company transactions have unique risks and require awareness of what it takes to operate as a public business. Internal controls, governance, technology, and more are essential.

-

Article

ArticleThree KPMG firms disciplined in $7.7M enforcement sweep

The Public Company Accounting Oversight Board announced $7.7 million in total penalties against three separate KPMG firms and four individuals for varying violations of audit standards and ethical rules, including alleged exam cheating.

-

Article

ArticleFive compliance triumphs from 2022

Positive contributions in the areas of ESG, AI responsibility, and setting standards regarding CCO liability highlight the latest installment of CW’s annual list of laudable ethics and compliance moments.

-

Article

ArticleAvaya discloses ICFR weaknesses linked to whistleblower logs

Avaya Holdings disclosed its assessment of internal control over financial reporting in its fiscal year 2021 annual report can’t be relied upon, along with acknowledging weaknesses in its ethics and compliance program.

-

Article

ArticleEx-Iconix CEO found guilty of accounting fraud

Neil Cole, the former CEO of Iconix Brand Group, faces possible jail time after his conviction of fraudulently inflating the brand management company’s revenue and misleading investors and auditors.

-

Article

ArticleUnisys: Probe identified ‘material weaknesses’ in disclosure controls

IT services company Unisys Corp. revealed the discovery of faults in its internal control over financial reporting, including involving its compliance functions, following an internal investigation it first disclosed earlier this month.

-

Article

ArticleNavigating using NFTs in business applications

Non-fungible tokens can take many forms. There are potential business applications already in use, and many more are being developed as technology evolves.

-

Article

ArticleEx-CEO at NS8 imprisoned 5 years, to forfeit $17.5M for fabricating revenue

The co-founder of NS8, a cyber-fraud prevention company, was sentenced to five years in prison and ordered to forfeit $17.5 million for defrauding investors of more than $100 million, the Department of Justice announced.

-

Article

ArticleSEC orders Koppers Holdings to pay $1.3M for disclosure failures

Koppers will pay $1.3 million to the Securities and Exchange Commission to settle allegations it failed to disclose material information about its debt in fiscal year 2019.

-

Article

ArticleKPMG finds large companies ‘on the precipice of a new era’ of ESG reporting

Sustainability reporting has seen steady growth over the past three decades while overall perspectives about environmental, social, and governance reporting have seen dramatic shifts, according to the latest findings of KPMG’s Global Sustainability Report.

-

Article

ArticleSurvey: How businesses are confronting governmental licenses in M&As

The results of a recent survey conducted by Compliance Week and Avalara found most businesses consider governmental licenses as part of due diligence efforts during mergers and acquisitions, yet the opportunity for risk management improvements remains.

-

Article

SEC passes Dodd-Frank executive pay clawback rule

The Securities and Exchange Commission passed a rule to require public companies to recover incentive-based compensation doled out to current and former executives up to three years before issuing an accounting restatement.

-

Article

ArticleCronos avoids fine in SEC settlement over accounting errors

Canadian cannabis company Cronos Group and its former chief commercial officer each avoided fines in reaching settlements with the Securities and Exchange Commission over alleged accounting fraud.

-

Article

ArticleImpact of FASB measuring crypto assets at fair value

The Financial Accounting Standards Board tentatively decided to require crypto assets that are in scope to be measured at fair value. Experts discuss the evolving ramifications of the project.

-

Article

ArticleMattel fined $3.5M over accounting misstatements; ex-PwC partner could face discipline

The Securities and Exchange Commission fined Mattel $3.5 million for allegedly overstating tax expenses and initiated litigation against a former PwC partner accused of failing to inform the toy company’s audit committee about its financial statement errors.

-

Article

ArticleKPMG affiliates fined $275K for using unregistered firms

Three affiliates of KPMG agreed to pay a total of $275,000 in penalties for failing to disclose unregistered firm participation in public company audits—the latest such PCAOB enforcement cases for the global accounting firm.