Articles | Compliance Week – Page 11

-

Article

ArticleFinCEN report identifies financial trends of Russian oligarchs

The Financial Crimes Enforcement Network published an analysis of financial trends involving Russian oligarchs and how U.S. financial institutions have aided in the identification of more than $30 billion worth of sanctioned Russians’ assets.

-

Article

ArticleLessons in preventing AML failures

Anybody working in financial services will know enormous effort is made to ensure their institution is on the right side of the law. Why, then, do such failures continue to exist? And crucially, what can be done to prevent their recurrence?

-

Article

Meta to pay $725M to settle privacy class-action lawsuit

Meta, the parent company of Facebook, agreed to pay $725 million to settle a class-action lawsuit accusing the social media giant of selling data to third parties without users’ consent.

-

Article

ArticleIrish DPC probing Twitter over breach affecting 5.4M users

The Irish Data Protection Commission is investigating whether Twitter violated the European Union’s General Data Protection Regulation regarding a data breach alleged to have affected 5.4 million users.

-

Article

ArticleAML 2023 preview: Regs not backing down on beneficial ownership, tech needs

Keeping up with increasingly demanding anti-money laundering expectations in 2023 will likely mean doing more with less and figuring out where and when is the best place to use technology to aid compliance, experts say.

-

Article

ArticlePCAOB enforcement roundup: Grant Thornton fined in disclosure crackdown

The Public Company Accounting Oversight Board announced several notable enforcement actions last week, including sanctions against six firms for allegedly violating agency reporting requirements.

-

Article

ArticleDOJ declines to prosecute Safran over alleged FCPA violations

The U.S. Department of Justice informed French aircraft equipment manufacturer Safran that the company would not face prosecution regarding alleged bribes paid by employees at two subsidiaries to a China-based consultant.

-

Article

ArticleESG in 2023: CSRD to put new pressures on EU businesses

Corporate reporting on everything from climate change to workers’ rights is set for a shake-up in the European Union, and companies should use 2023 to prepare for new regulations and stakeholder expectations.

-

Article

SEC taps Megan Barbero as general counsel; Dan Berkovitz to depart

The Securities and Exchange Commission announced General Counsel Dan Berkovitz will depart the agency, effective Jan. 31, 2023. Megan Barbero, currently principal deputy general counsel, will be appointed general counsel upon Berkovitz’s exit.

-

Article

ArticleSEC fines PNC unit over municipal bond disclosure lapses

Broker-dealer PNC Capital Markets agreed to pay nearly $200,000 and be censured to resolve Securities and Exchange Commission allegations it violated rules related to limited offerings of municipal securities.

-

Article

ArticleDeloitte fined $1.1M for SIG audit lapses

Deloitte received a penalty of £906,250 (U.S. $1.1 million) from the U.K. Financial Reporting Council for evidence failures regarding supplier rebates and cash uncovered in its 2015 and 2016 financial year audits at specialist building product distributor SIG.

-

Article

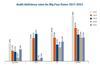

ArticlePCAOB 2021 inspection reports: PwC sees best results again; EY deficiencies increase

For the second straight year, PwC fared the best among inspection results released by the Public Company Accounting Oversight Board for the largest U.S. audit firms, including each of the Big Four, Grant Thornton, and BDO.

-

Article

ArticleManaging sanctions risk: Keys to successful implementation

The International Compliance Association hosted a webinar looking at challenges faced by organizations regarding changes in the sanctions landscape in 2022. Holly Thomas-Wrightson offers a recap of the discussion.

-

Article

ArticleBioTelemetry to pay $44.8M over India testing false claims

BioTelemetry and CardioNet agreed to pay more than $44.8 million to settle allegations they violated U.S. federal health laws by improperly billing Medicare and other federal programs for heart monitoring and cardiac test analyses performed by a company in India.

-

Article

Exela Technologies, ex-CFO settle SEC control failure charges

Texas-based IT firm Exela Technologies and its former CFO settled charges brought by the Securities and Exchange Commission alleging failure to properly account for and record liabilities related to a shareholder lawsuit.

-

Article

Article‘Period of uncertainty’ projected as U.K. embarks on ‘Edinburgh Reforms’

The “Edinburgh Reforms” aim to establish a smarter regulatory framework for the United Kingdom that is agile, less costly, and more responsive to emerging trends. Experts weigh in on the proposed changes.

-

Article

Caterpillar names chief sustainability officer

Construction equipment manufacturer Caterpillar announced Dr. Lou Balmer-Millar will assume responsibility for the chief sustainability officer role.

-

Article

ArticleTSB Bank fined $59.2M for governance lapses in botched IT migration

TSB Bank was fined £48.65 million (U.S. $59.2 million) by U.K. regulators after a disastrous IT migration left customers unable to access cash or use online accounts for weeks.

-

Article

ArticleCHS Hedging AML controls criticized in $6.5M CFTC action

CHS Hedging, a Minnesota-based futures commission merchant, was fined $6.5 million by the Commodities Futures Trading Commission for AML program gaps and other risk management and recordkeeping failures regarding a ranch owner customer committing fraud.

-

Article

ArticleCFPB reaffirms tougher stance with $3.7B Wells Fargo settlement

Wells Fargo will pay a total of $3.7 billion to address “widespread mismanagement” of auto loans, mortgages, and deposit accounts as part of a settlement with the Consumer Financial Protection Bureau.