All Surveys & Benchmarking articles – Page 24

-

Article

ArticleESG reporting: A summary of preparers’ perspectives

Preparers speaking at a pair of recent high-profile accounting and auditing conferences discuss current practices and the challenges their controllership teams face in ESG reporting and governance.

-

Article

ArticleTI 2021 corruption index shows world not willing to make real change

The adage that “no news is good news” doesn’t apply to Transparency International’s 2021 Corruption Perceptions Index. That corruption levels remain at a global standstill or have worsened highlights a disturbing trend for companies, governments, and citizens alike.

-

Article

ArticleHow Covid-19 has redefined the seamless audit process

The pandemic has forced companies to make significant changes to their internal audit processes and how they prepare for external auditors to review their financials. A recent CW webcast sponsored by BlackLine explored how technology can help meet these new challenges.

-

Article

ArticleNAVEX: Top 10 risk and compliance trends for 2022

Diversity, equity, and inclusion; prioritizing ESG; business continuity; and more highlight the latest edition of NAVEX’s annual list of risk and compliance trends worth monitoring.

-

Article

ArticleReport: Financial crime fines down in 2021; AML penalties drop 78 percent

Fines for corporate crimes last year fell by more than half to 8.7 billion euros (U.S. $9.9 billion) from 2020’s total of €20 billion (U.S. $22.6 billion), according to a report released by research firm AML Intelligence.

-

Article

ArticleReport: GDPR fines surpass $1B in 2021; breach notifications also rise

Nearly €1.1 billion (U.S. $1.2 billion) worth of fines have been issued against organizations in the past year for violations of the General Data Protection Regulation, according to the latest annual report by law firm DLA Piper.

-

Article

ArticleCCO liability framework seeks to acknowledge compliance support concerns

The National Society of Compliance Professionals has drafted a framework that urges regulators to consider chief compliance officer liability more holistically, in the context of the compliance culture within a CCO’s firm.

-

Article

ArticleReport: FCPA investigations, enforcement actions hit 10-year lows in 2021

The number of enforcement actions brought under the Foreign Corrupt Practices Act in 2021 fell to the lowest total in a decade, according to a new report by the FCPA Clearinghouse at Stanford Law School.

-

Article

ArticleReport: Financial services fines drop 49 percent in 2021

The value of penalties against global financial services firms in 2021 dropped to half the total levied in 2020, according to research by compliance technology provider Fenergo.

-

Article

ArticleReport: Cryptocurrency-related crime reaches record $14B in 2021

The amount of illicit cryptocurrency transactions reached an all-time high in 2021 at $14 billion, according to a Chainalysis study due out next month. The rise coincides with significant increases in the overall volume of crypto transactions.

-

Article

ArticleHow to identify ultimate beneficial owners

As financial institutions continue to face enhanced public scrutiny and potential regulatory attention, it is important they allocate competent resources to their AML programs regarding beneficial ownership.

-

Article

ArticleISACA issues audit resources on SOX, VPNs, agile auditing

The ISACA, an international professional association focused on IT governance, released three new resources designed to assist audit professionals in enhancing their skills to meet the needs of the evolving audit landscape.

-

Article

ArticleCybersecurity trends continue in 2021 audit committee transparency report

The most dramatic increase in audit committee disclosures in proxy statements for the second consecutive year was in responsibility for cybersecurity risk oversight, according to the latest report from the Center for Audit Quality and Audit Analytics.

-

Article

ArticleSurvey highlights need for better data integration between risk and compliance

A recent survey from Compliance Week and Riskonnect presents a compelling argument for companies to invest in bridging the gap between risk management and compliance data.

-

Article

ArticleOCC guidance: Six principles for large banks managing climate risks

The Office of the Comptroller of the Currency published draft guidance for large banks to identify, measure, monitor, and control climate-related risks to ensure the safety and soundness of their institutions and the market.

-

Article

ArticleTCFD recommendations more than building block for SEC climate disclosure rules?

SEC Chair Gary Gensler has hinted the agency’s highly anticipated climate-related disclosure rules will likely be pegged to an international framework, specifically mentioning the Task Force on Climate-Related Financial Disclosures. How can the TCFD help companies prepare for what’s ahead?

-

Article

ArticleBiden corruption strategy puts FCPA in spotlight overseas

President Joe Biden’s strategy on countering corruption shows tackling corporate abuses overseas is firmly back on the U.S. agenda. As such, European companies and executives should beware: The Foreign Corrupt Practices Act is likely to get a dusting off.

-

Article

ArticleReport: Restatements drop to record low in 2020

Financial statement restatements by public companies declined in 2020 to their lowest level in 20 years, according to the latest Audit Analytics study.

-

Article

ArticleRisk and compliance considerations for fintech startups and their bank relationships

Fintech startups are typically free to enjoy rapid growth without the burden of strict regulatory oversight. But as scrutiny over the industry grows, so does the urgency for fintechs to get their compliance house in order.

-

Premium

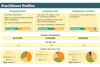

PremiumGraphic: 2021 CCO salary practitioner profiles

Benchmark against your peers with chief compliance officer salary data from over 300 respondents to our annual Inside the Mind of the CCO survey.