All Surveys & Benchmarking articles – Page 21

-

Article

ArticleSurvey: Legal heavily involved in ESG strategy, less so in compliance

Less than one-fifth of global corporate legal departments in a recent survey reported heavy involvement with environmental, social, and governance compliance, though three-quarters said they had been extremely involved in drafting their companies’ ESG strategy.

-

Article

ArticleReal talk: How Best Buy manages challenges of DEI goals

Two years into its diversity, equity, and inclusion action plan, Best Buy leaders attended Compliance Week’s National Conference to discuss—in a refreshingly blunt manner—the retailer’s learnings.

-

Article

ArticleReport: SPACs drive restatement surge in 2021

The total number of restatements and individual companies disclosing restatements in 2021 rose to their highest levels since 2006, according to Audit Analytics’ latest annual review.

-

Article

ArticleFactors to consider when implementing risk assessment technology

With the growing demands of huge data sets, an everchanging regulatory landscape, and constantly evolving typologies, the challenge of assessing, documenting, and managing financial crime risk has never been greater.

-

Article

ArticleLessons learned from Olympus compliance monitorship

Christine Gordon, chief compliance officer at Olympus Corporation of the Americas, spoke about her company’s experience working with a DOJ-selected independent monitor at Compliance Week’s National Conference.

-

Article

ArticleTen highlights from Compliance Week 2022

Editor In Chief Kyle Brasseur recaps the moments that stood out to him most from Compliance Week’s first in-person event since 2019.

-

Article

ArticleCompliance execs get candid on industry challenges at CW think tank

Fifteen high-level compliance executives discussed the challenges and opportunities presented by an ever-changing compliance landscape during a first-ever executive think tank session at Compliance Week’s 2022 National Conference in Washington, D.C.

-

Article

ArticleFedEx’s social mission: Diversity drives better business

FedEx’s DEI strides—including becoming a minority-majority employee company in the U.S. for the first time in its history in fiscal year 2018—are not by accident. The company’s long history of hiring a diverse workforce and promoting from within is among the keys to its success.

-

Article

ArticleGrowth vs. green: FedEx’s environmental balancing act

When FedEx published its first Global Citizenship Report in 2008, its greenhouse gas emissions were already top of mind. Yet, the company has struggled to strike a balance between achieving year-over-year decreases in total emissions while it has expanded in the last decade-plus.

-

Article

ArticleReport: Investigation costs rising, driven by data assessment inefficiencies

More than three-quarters of respondents to a Kroll global benchmark report said they have conducted an internal investigation into fraud or corruption within the past three years and that the cost of such probes is on the rise.

-

Article

Article‘A marathon, not a sprint’: FedEx carbon-neutral pledge tests longtime ESG efforts

In March 2021, FedEx announced an audacious goal: to achieve carbon-neutral operations globally by 2040. How did the company develop this pledge, and how will it track its progress and hold itself accountable to intermediate goals?

-

Article

ArticleDesire for transparency launches FedEx on ESG journey

Since 2008, FedEx has produced detailed reports on its ESG initiatives. The company’s chief sustainability officer discusses the decision-making process behind the first report, determining materiality, and more in Part 1 of this four-part special report, published in partnership with the ICA.

-

Article

ArticleReport: European AML compliance efforts remain substandard

European governments need to step up their efforts to combat money laundering and terrorist financing because their current capabilities are below par, according to a report by the Council of Europe’s Moneyval unit.

-

Article

ArticleTips from a project management expert on avoiding failure

Research shows more than 60 percent of projects undertaken fail. Antonio Nieto-Rodriguez, considered the No. 1 project management expert in the world, shares steps to take to avoid contributing to this statistic.

-

Article

ArticleSurvey: Lease accounting implementation at critical point

The “2022 Global Lease Accounting Survey” from EY and LeaseAccelerator covers how public and private companies address U.S. and international accounting requirements and challenges they have had and expect to face post-implementation.

-

Article

ArticleNAVEX: Whistleblowers ‘more emboldened than ever’

NAVEX’s 2022 “Hotline & Incident Management Benchmark Report” provides chief compliance officers with valuable insight into how their hotline and incident management program stacks up against their peers.

-

Article

ArticleBreaking the glass ceiling in ethics and compliance

Jane Levine, chief compliance officer at DailyPay, shares three suggestions for ensuring women are empowered within the ethics and compliance profession.

-

Article

ArticleReport: Pandemic fuels goodwill impairment spike in 2020

Goodwill impairment recorded by U.S. public companies more than doubled in 2020, but the total still fell short of the figure observed at the onset of the 2008 financial crisis, according to the latest annual report from Kroll.

-

Article

ArticleAA study: Cybersecurity breach disclosures surge in 2021

The number of cybersecurity breaches disclosed by public companies in 2021 increased 44 percent while reports of ransomware attacks also surged, according to the latest Audit Analytics study.

-

Article

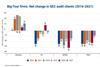

ArticleAudit client turnover 2021: Deloitte, Grant Thornton lead national firms; EY, KPMG, PwC see declines

Deloitte and Grant Thornton each had net increases in new public company audit clients in 2021, but all but one of the other Big Four and global and national firms experienced net decreases or no change, according to the latest annual study.