All SEC articles – Page 31

-

Article

ArticleNew bill seeks shorter wait for SEC whistleblower awards

The “SEC Whistleblower Reform Act of 2022” proposes to shorten the wait time for a whistleblower to receive a payout by requiring the Securities and Exchange Commission to issue an initial ruling on a claim within one year of the deadline to file the claim.

-

Article

ArticleQ1 roundup: SEC tackles climate disclosures, businesses navigate Russia restrictions, more

Regulation and guidance from U.S. agencies and the White House, plus compliance challenges stemming from a two-year global pandemic and Russia’s ongoing invasion of Ukraine, made the first quarter of 2022 a novel risk environment for regulated businesses.

-

Article

ArticleSenators call for close of private investment AML/CFT loophole

Sens. Sheldon Whitehouse (D-R.I.) and Elizabeth Warren (D-Mass.) called on the Treasury Department and SEC to close a “disconcerting loophole” that exempts hedge funds and other private investment firms from reporting suspicious activity within their transactions to authorities.

-

Article

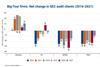

ArticleAudit client turnover 2021: Deloitte, Grant Thornton lead national firms; EY, KPMG, PwC see declines

Deloitte and Grant Thornton each had net increases in new public company audit clients in 2021, but all but one of the other Big Four and global and national firms experienced net decreases or no change, according to the latest annual study.

-

Article

ArticleBaidu headlines new batch of HFCAA designations

Technology giant Baidu is the latest high-profile Chinese company to be warned by the Securities and Exchange Commission of potential delisting under the Holding Foreign Companies Accountable Act.

-

Article

ArticleReported SEC probe of Big Four taking page from U.K. breakup plans?

The Securities and Exchange Commission is reportedly investigating whether large audit firm consulting services affect auditor independence. Any action taken might mirror the United Kingdom’s ongoing actions to break up the Big Four’s dominance.

-

Article

SEC names new acting head of Division of Examinations

Richard Best will become acting director of the Division of Examinations at the Securities and Exchange Commission, following the announced departure of Daniel Kahl.

-

Article

ArticleHow to prepare for SEC’s climate-related disclosure rule

The Securities and Exchange Commission’s proposed climate-related disclosure rule would force companies that have been reluctant to initiate a self-examination of their environmental impact to do so, posthaste. Experts weigh in on where to start.

-

Article

ArticleSEC adds Weibo to HFCAA watchlist

The Securities and Exchange Commission added Chinese social media giant Weibo Corp. to its list of companies not in compliance with the Holding Foreign Companies Accountable Act.

-

Article

SEC releases highly anticipated climate-related disclosure rule

After months of anticipation, the Securities and Exchange Commission issued its proposed climate-related disclosure rule, a sweeping potential mandate that would force all public companies to quantify, measure, and disclose their effect on the environment.

-

Article

ArticleSEC staff warn broker-dealers ‘remain vigilant’ amid market volatility

Amid Russia’s invasion of Ukraine, SEC staff issued a statement warning broker-dealers and other market participants to “remain vigilant to market and counterparty risks that may surface during periods of heightened volatility and global uncertainties.”

-

Article

ArticleSEC Commissioner Allison Herren Lee to not seek second term

Allison Herren Lee announced she will not seek a second term as a commissioner at the Securities and Exchange Commission once her current term expires in June.

-

Article

ArticleSEC notifies five Chinese companies of HFCAA noncompliance

The Securities and Exchange Commission has notified five China-based public companies they could be delisted from U.S. stock exchanges if they do not allow their audits to be inspected by the Public Company Accounting Oversight Board.

-

Article

ArticleSEC to discuss climate-related disclosure rule on March 21

The Securities and Exchange Commission will discuss its anticipated new rule ordering public companies to issue climate-related disclosures at its open meeting March 21.

-

Article

ArticleSEC proposes companies report cybersecurity incidents within four days

Public companies would have to report material cybersecurity incidents no later than four business days after they occur if a rule proposed by the Securities and Exchange Commission takes effect.

-

Article

ArticleTop 10 reasons to attend Compliance Week 2022

A keynote with two SEC commissioners; interactive sessions on global sanctions, ESG, and ethical leadership; and a new conference location and format highlight Dave Lefort’s list of reasons to be excited for CW’s first in-person event in nearly three years.

-

Article

ArticleSix years later, CW whistleblower subject receives award

Andrew Russo, one of five whistleblowers to share their stories in CW’s “Witness to Wrongdoing” series, has finally received an award from the Securities and Exchange Commission, nearly six years after he filed his claim.

-

Article

ArticleShould SEC hold securities lawyers accountable for bad advice?

A commissioner at the Securities and Exchange Commission has proposed establishing a minimum set of standards for lawyers advising public companies on securities law to combat a trend of “overzealous” representation.

-

Article

ArticleCity National Rochdale to pay $30.4M for undisclosed conflicts of interest

Registered investment adviser City National Rochdale has agreed to pay $30.4 million in a settlement with the Securities and Exchange Commission for conflict-of-interest violations.

-

Article

ArticleThe Cassava Sciences saga: Short sellers, ‘gaming’ the FDA, and the damaging ripple effects

The Federal Drug Administration’s decision last month to deny a citizen petition on behalf of short sellers with positions in Cassava Sciences stock highlights the damage the commonly exploited regulatory process can have on a company, regardless of innocence or guilt.