Articles | Compliance Week – Page 116

-

Article

ArticleSEC, China react as Trump approves foreign audit oversight bill

President Donald Trump signed into law a measure that will kick publicly traded Chinese companies off U.S.-based exchanges if they refuse to allow U.S. regulators to examine their finances.

-

Article

ArticleNew Zealand’s new privacy law comes with a refreshing twist—it allows for apologies

New Zealand’s new data privacy law allows an apology to be made without admitting guilt, a provision that follows with the island’s non-traditional form of leadership as one that focuses on empathy and the well-being of the people.

-

Article

U.K. court upholds insider trading charges against former UBS compliance officer

A U.K. appeals court upheld five insider trading convictions against a former senior compliance officer at investment bank UBS.

-

Article

ArticleEY member firm fined $1.5M for failure to uncover $3B homebuilding fraud

A member firm of EY Global has been fined $1.5 million by the SEC to settle audit violations and improper conduct charges connected to a $3.3 billion accounting fraud committed by one of its customers.

-

Article

ArticleConfidence is the ultimate tool in fighting fraudsters

Con men will try to bully weak investigators and sell them their version of “the truth,” writes Martin Woods. The ultimate deterrent is to challenge their “facts” and act with the same confidence they display.

-

Article

ArticleCyber-security lessons from the SolarWinds hack

The lessons from the massive SolarWinds hack on where vulnerabilities still lurk in the third-party vendor supply chain cannot be grasped soon enough.

-

Article

ArticleLuckin Coffee to pay $180M for accounting fraud

China-based Luckin Coffee has agreed to a $180 million penalty as part of a settlement with the U.S. Securities and Exchange Commission to resolve charges related to the coffee chain’s inflated-sales scandal.

-

Article

ArticleFinTech darling Robinhood fined $65M for misleading customers

Mobile trading app provider Robinhood Financial, which has become a disruptive force in the stock market, has agreed to pay $65 million to the SEC to settle charges of misleading customers about how it makes money and for failing to secure best sale prices.

-

Article

ArticlePoll: More companies linking ESG initiatives to executive incentive plans

Current events have significantly accelerated the need for companies around the world to link ESG initiatives to their executive incentive plans, according to a recent poll conducted by Willis Towers Watson.

-

Article

ArticleThird time’s a charm? SEC adopts controversial extraction rules

After two failed iterations, the SEC has approved revamped rules laying out what commercial oil, natural gas, and mineral extraction companies must disclose about payments they make to U.S. and foreign governments.

-

Article

ArticleBarclays fined $34.8M over treatment of cash-strapped customers

The U.K. Financial Conduct Authority fined Barclays Bank and its related units £26 million (U.S. $34.8 million) for poor treatment of consumer credit customers experiencing financial hardship.

-

Article

ArticleBest practices for customized digital compliance training

Today’s volatile market, coupled with the increasing willingness of subject matter experts to collaborate, changes the game in some areas, where “build” starts to make more sense than “buy.” One area is digital compliance training.

-

Article

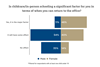

ArticleSurvey: Remote work poses different challenges for men and women

A CW survey finds male and female compliance practitioners are processing the pressure points of the pandemic differently, and that fully remote work is leading to a permanently changed future for post-pandemic work schedules.

-

Article

ArticleThe growing demand for investigation skills in compliance

As the compliance world evolves, the skill sets needed by practitioners are changing. The ability to run investigations effectively is now highly prized, and key skills, such as understanding the use of technology, will be among the most fundamental in the years ahead.

-

Article

ArticleWomen in compliance: Be unapologetic about moving up … but send the elevator back down

Over the course of reading two books, Julie DiMauro got some important tips and reminders about taking risks, creating success, and being cognizant of those women following in our career footsteps.

-

Article

FTC data requests could pave way to federal privacy law, experts say

FTC requests issued to nine social media and video streaming services for information about how they collect and use personal information could be a step toward the U.S. government enacting federal privacy legislation.

-

Article

ArticleFASB Chair Jones projects pandemic challenges to persist in 2021

New FASB Chairman Richard Jones said in a recent speech that he believes accounting challenges from the coronavirus pandemic won’t go away soon, with his organization poised to address new issues as they arise.

-

Article

ArticleTwitter’s tiny $547K GDPR fine leaves many scratching their heads

Ireland’s first major decision against a Big Tech company under the GDPR has stirred controversy as the country’s data regulator hit Twitter with an underwhelming €450,000 (U.S. $547,000) fine for a 2018 data breach.

-

Article

ArticleSurvey: Remote compliance practitioners feel supported, but for how long?

A recent survey of 180 compliance, risk, and audit professionals asked the question: “What’s your back-to-office plan, and does it work for you?” The short answer was there is no plan, and the status quo is faring better for the company than the employee.

-

Article

ArticleSEC charges CCO over illegal security sales practices

A chief compliance officer is one of three individuals on the receiving end of SEC charges for illegally selling securities in unregistered transactions to retail investors while acting as an unregistered broker.