All Basel III articles

-

News Brief

News BriefBarr speech signals Fed to rework capital rules after pressure from industry

Facing intense pressure from the banking industry, the Federal Reserve Board may scale back two controversial rule proposals aimed at reducing risks of bank failures in the event of a market downturn.

-

Article

ArticleBasel Committee seeks comment on principles for operational resilience

The Basel Committee on Banking Supervision is seeking comment from the financial services industry on its proposed principles for operational resilience that aim to enhance banks’ ability to withstand, adapt to, and recover from potentially severe adverse events.

-

Blog

Groups propose new structure for global auditing standards

A group of international regulators and financial institutions is proposing a new mechanism to set standards for auditing in global capital markets.

-

Blog

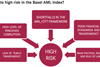

Basel AML index: countries still fall—sometimes severely—short

The annual Basel Anti-Money Laundering Index, a ranking of 146 countries regarding money laundering risks, is out. The findings show that plenty of work on the issue remains to be done.

-

Blog

A plea to G20 leaders about systemic risk

In a new letter to world leaders, the Systemic Risk Council is urging G20 countries to resist any pressure to weaken global financial reform measures.

-

Article

Will Europe go it alone on financial regulation following Brexit? Don’t count on it

It might seem logical for a post-Brexit European Union to follow a maverick regulatory path, but such a reality is more of a dream than a reality. Tim Sprinkle explains.

-

Blog

BlogBasel Index finds slippage in AML efforts

The Basel Committee on Banking Supervision, an international consortium that develops banking standards, has issued its “Basel AML Index,” an annual ranking of country risk regarding money laundering and terrorism financing. The overall conclusion this year, says Joe Mont: A majority of countries fall short in the effective implementation and ...

-

Blog

FSB: Banks Must Devote Billions More to Capital Cushions

The world’s largest banks would need to collectively add as much as $1.2 trillion to existing capital buffers due to a new rule issued on Monday by the Financial Stability Board. Its final Total Loss-Absorbing Capacity (TLAC) standard, applicable to designated global systemically important banks, is intended to assure that ...

-

Blog

Insurers Brace for International Capital Standards

The International Association of Insurance Supervisors seeks to impose new capital standards upon systemically important insurance companies, echoing mandates from the Basel Committee on Banking Supervision. The effort has irked the Financial Services Roundtable, which is urging U.S. regulators to oppose it. Who enforces any new standards is also unclear. ...

-

Blog

FDIC’s Hoenig Pitches Framework for Regulatory Relief

Thomas Hoenig, vice chairman of the Federal Deposit Insurance Corporation, wants to see the regulatory burden for “traditional” banks eased, regardless of their asset size. Speaking on this week about a Congressional demand to identify outdated and unduly burdensome regulations he recommended that a bank be eligible for regulatory relief ...

-

Blog

Survey: Global Regulations Cost Some Financial Firms $500 Million

More than half of large financial services firms with more than $40 billion in assets expect to invest at least $200 million—and some as much as $500 million—on projects to overhaul how they do business and address global structural reform regulations this year, according to a survey from global consultancy ...

-

Blog

Basel Pitches Bank Rules to Remedy Interest Rate Shocks

The Basel Committee on Banking Supervision, with a consultative document released on Monday, is seeking public comment on proposals regarding what measures large banks should take, and how much reserve capital they should hold, to weather interest rate risks. More inside.

-

Blog

Who Is the Most Systemic of Them All? JP Morgan

Which large U.S. bank would cause the most collateral damage if it were to fail? JP Morgan, according to a new report from the Treasury Department. The report tried to quantify just how much systemic risk exists in banks designated as “Systemically Important Financial Institutions,” and JP Morgan topped the ...

-

Blog

Fed Seeks New Capital Requirements for Biggest Banks

Image: Dec. 9—The Federal Reserve is proposing a new risk-based capital surcharge for the most systemically important firms. The proposed rule would implement a new methodology for determining “global systemically important” banks and increase mandated capital conservation buffers by as much as 4 percent. The proposal establishes five broad categories ...