- Home

-

News

- Back to parent navigation item

- News

- National Compliance Officer Day 2025

- Accounting & Auditing

- AI

- AML

- Anti-Bribery

- Best Practices

- Boards & Shareholders

- Cryptocurrency and Digital Assets

- Culture

- ESG/Social Responsibility

- Ethics & Culture

- Europe

- Financial Services

- Internal Controls

- Regulatory Enforcement

- Regulatory Policy

- Risk Management

- Sanctions

- Surveys & Benchmarking

- Supply Chain

- Third Party Risk

- Whistleblowers

- Opinion

- Benchmarking

- Certification

- Events

- Research

- Awards

-

CW Connect

- Back to parent navigation item

- CW Connect

- Sign In

- Apply

- Membership

- Contact

Women on boards: non-executive progress, executive stagnation

By Paul Hodgson2016-05-10T10:00:00

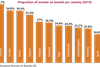

A new study of female representation on boards ranks Norway first, with women comprising, on average, 38.7 percent of total board membership. Switzerland ranks dead last, with average representation of women at just 16.1 percent. Paul Hodgson provides an in-depth look at the results.

THIS IS MEMBERS-ONLY CONTENT

You are not logged in and do not have access to members-only content.

If you are already a registered user or a member, SIGN IN now.

Related articles

-

Article

ArticleCalifornia first U.S. state to mandate women on boards

2018-10-02T16:15:00Z By Joe Mont

Boards of directors for California public companies will now need to ensure that they seat more women at the table.

-

Article

Executives and investors form alliance to drive better governance

2016-07-26T10:45:00Z By Joe Mont

In part an after-effect of say-on-pay rules, shareholders are finding corporate executives and their boards increasingly willing to improve upon their once confrontational relationship. Joe Mont reports.

-

Article

New blood at the Serious Fraud Office

2016-06-21T12:00:00Z By Paul Hodgson

A report from Her Majesty’s Crown Prosecution Service Inspectorate has attacked the Serious Fraud Office for being a largely white, all-male board. Paul Hodgson examines the merits of the report and the SFO’s response.

- Terms and Conditions

- Privacy Policy

- Do Not Sell My Info

- © 2025 Compliance Week

Site powered by Webvision Cloud