All articles by Maria L. Murphy

-

Premium

PremiumThe auditor’s role in supply chain due diligence

Although compliance should be the company’s primary responsibility, auditors have become the last line of defense and are getting pressured and blamed for supply chain issues, including instances of child labor. Is this expected to become the normal for the profession?

-

Premium

PremiumWhat future holds for PCAOB post China crackdowns

The Public Company Accounting Oversight Board’s first enforcement settlements with mainland China and Hong Kong firms won’t be the last, as the chair of the regulator says its “just getting started.” U.S. firms must be mindful of the specific ethical issues highlighted.

-

Premium

PremiumAuditor independence on regulators’ radars

The Public Company Accounting Oversight Board and Securities and Exchange Commission have emphasized in public statements auditor independence is a critical enforcement area, prompting the need for firms to reacquaint themselves with each agency’s requirements.

-

Premium

PremiumPoll finds finance empowerment key to ESG reporting confidence

The Deloitte Center for Controllership released new data that indicates confidence levels in environmental, social, and governance financial reporting are low.

-

Premium

PremiumNeed to know: FASB proposal on accounting for crypto assets

The Financial Accounting Standards Board issued a proposed accounting standards update to improve accounting and disclosures for certain crypto assets.

-

Premium

PremiumAccounting and reporting challenges of environmental credits

Companies are working on plans to reduce their carbon emissions. The popularity of environmental credits has grown as a way for companies to meet their emission reduction targets.

-

Premium

PremiumCybersecurity challenges: Defense and disclosure

Experts share perspectives regarding the criticality of cybersecurity risks, what the response of management and boards should be, and how proposed disclosure requirements need to be incorporated into cyber-related responsibilities.

-

Premium

PremiumReport: Audit committees bracing for increased role in ESG, ERM, cyber

A new report from the Center for Audit Quality and Deloitte found corporate boards are taking a fresh look at their audit committee structures and practices to respond to emerging corporate reporting areas and increased risks.

-

Premium

PremiumClimate and sustainability reporting challenges: Auditors’ perspectives

Partners from several of the top global accounting firms shared perspectives about the state of sustainability reporting and the impact on auditors and their clients at a recent industry event.

-

Article

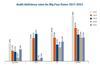

ArticlePCAOB 2021 inspection reports: PwC sees best results again; EY deficiencies increase

For the second straight year, PwC fared the best among inspection results released by the Public Company Accounting Oversight Board for the largest U.S. audit firms, including each of the Big Four, Grant Thornton, and BDO.

-

Article

ArticleESG oversight highlighted in annual audit committee transparency report

Public companies continue to increase the overall level of audit committee disclosures in proxy statements, though there is room to improve quality by providing more tailored disclosures and transparency, according to the latest annual report.

-

Article

ArticleChallenges for SPACs: Public company, now what?

Special purpose acquisition company transactions have unique risks and require awareness of what it takes to operate as a public business. Internal controls, governance, technology, and more are essential.

-

Article

ArticleNavigating using NFTs in business applications

Non-fungible tokens can take many forms. There are potential business applications already in use, and many more are being developed as technology evolves.

-

Article

ArticleImpact of FASB measuring crypto assets at fair value

The Financial Accounting Standards Board tentatively decided to require crypto assets that are in scope to be measured at fair value. Experts discuss the evolving ramifications of the project.

-

Article

ArticleNeed to know: FASB requires supplier finance program disclosures

The Financial Accounting Standards Board added new disclosure requirements for buyers of goods and services intended to increase transparency about how they use supplier finance programs.

-

Article

ArticleAA study: Total audit fees rise in 2021

Total audit fees increased in fiscal year 2021 as the number of Securities and Exchange Commission registrants reached its highest total in six years, according to the latest annual review from Audit Analytics.

-

Article

ArticleWorkforce changes impacting accounting and finance recruitment, retention efforts

More than 80 percent of public companies reported accounting and finance talent retention issues over the past 12 months, according to a Deloitte Center for Controllership webcast poll.

-

Article

ArticlePCAOB forecasts stricter oversight in five-year strategy

The Public Company Accounting Oversight Board issued its draft five-year strategic plan for public comment. Areas of focus include enhancing audit inspections, strengthening enforcement, and more.

-

Article

ArticleSarbanes-Oxley 20th anniversary: Time to revisit SOX programs

Twenty years ago, in the aftermath of the Enron and WorldCom financial reporting scandals, Congress acted and created the Sarbanes-Oxley Act of 2002. Such a milestone anniversary marks a good time for organizations to refresh, rethink, and modernize their SOX programs.

-

Article

ArticleAssessing results of FASB’s 2021 agenda consultation report

The Financial Accounting Standards Board’s 2021 agenda consultation report summarizes the extensive feedback FASB received when it asked stakeholders where it should focus its time and resources.