Climate-related disclosure efforts are amplifying year over year (YOY), despite persistent and persnickety pain points, as more organizations widen the scope of the “discovery phase” of their environmental, social, and governance (ESG) journeys.

For the second year, Compliance Week polled risk and compliance practitioners on their climate-related disclosure efforts as part of our annual “Inside the Mind of the CCO” survey. The survey received 322 responses; of that total, 128 said they must comply with the Securities and Exchange Commission’s proposed climate-related disclosure rule and/or the European Union’s Corporate Sustainability Reporting Directive (CSRD).

Nearly half (44 percent) the respondents in the cohort were chief compliance officers or chief ethics and compliance officers. Forty percent said they worked at organizations with more than 10,000 employees, 27 percent at companies with fewer than 1,000 employees, and 21 percent at companies between 1,000 and 5,000 employees.

For nearly half (45 percent) the practitioners, both the CSRD and the proposed SEC rules will pertain to their business. About a third (34 percent) said only the SEC rules have relevance, while the remaining 21 percent said only the CSRD will apply.

By and large, companies made strides on their ESG journeys over the last 12 months. More than a third of the cohort (38 percent) represented their firms have pursued peer benchmarking and prepared inaugural ESG reports among preparation efforts, up 7 percent and 14 percent, respectively, YOY. The proportion of respondents whose companies began quantifying Scope 3 emissions jumped from 16 to 29 percent YOY, and the number of firms that commissioned materiality assessments rose from 20 to 28 percent.

The findings are in line with what Robert Michlewicz, chief executive of lease optimization solution provider Visual Lease, is seeing. The company performed its own 2023 environmental impact reporting survey and found comparable results, with less than a third of participants having an established ESG reporting framework in place.

Mihir Jhaveri, partner and risk and sustainability practice leader at Centri Business Consulting, was also unsurprised by the results.

“A lot of these companies are really in the discovery phase,” he said. ESG reporting and goal-setting is “a nice-to-have right now. It’s not a need-to-have for a lot of the small to midsize companies,” Jhaveri added.

The most marked YOY improvements emerged in the categories of inaugural ESG reports and Scope 3 emissions data quantification, possibly indicating more organizations have transitioned from the earliest stage of building an ESG program to embarking on the intermediate stage of transforming sustainability objectives into measurable impact.

In all categories represented by the question, there was no area that elicited an overwhelmingly affirmative response. Only 11 percent of respondents admitted their firm was not preparing for ESG reporting mandates at all.

Michlewicz and Jhaveri suggested this discrepancy could have a few explanations.

“Some organizations may be very early in the process of even gathering the related data, whereas others really might not yet trust the data due to their incomplete or untested processes delivering repeatable data sets, period over period,” Michlewicz said.

“A lot of firms are getting themselves educated and doing research,” Jhaveri pointed out. “So, have they really started? No. When you start adding those numbers into the context, it’s a much larger number than 11 percent.”

Nevertheless, general inertia on the matter of ESG appears to be lessening, as respondents who indicated their firm was not preparing for ESG reporting mandates dropped YOY from 35 percent.

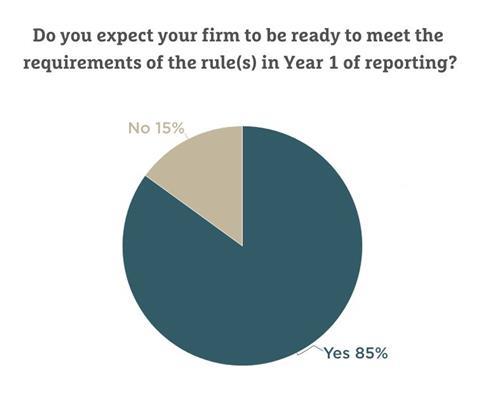

Indeed, 85 percent of respondents said they expected their firms would meet the requirements of the rules in Year 1 of reporting.

“This does seem to be overconfident,” Michlewicz said. “[I]n our recent analysis, we found that nearly 70 percent of those that we surveyed in senior financial executive positions said their organizations are not fully prepared to track and measure the environmental impact of their leased and owned asset portfolios … which has a direct implication on the reporting efforts.”

Jhaveri was equally surprised by the overconfidence.

“We don’t know when ‘Year 1’ is,” he said. “… If it’s next year, there’s no way the majority of companies are going to be ready.”

The pain points of last year are ongoing in 2023. The sheer volume and complexity of data collection; the challenges of complying with sprawling, dynamic laws; and the lack of leadership support and adequate resourcing lead ESG to be pigeonholed as an unenviable area of the business.

Asked to rank these challenges, Michlewicz said he believed navigating the volume and complexity of data collection to be the most controllable.

“Ensure the company has established a holistic system of record for the data you will use for your sustainability reporting,” he advised. “Find a way to streamline any manual processes that are driving that system of record. Then, establish a controls framework underneath those processes around those critical data points that you’re going to use for the ESG initiatives.”

Jhaveri said he believed garnering leadership support of ESG to be the most surmountable challenge.

“What is not in your control are laws and regulations … or the maturity of the ecosystem around the data,” he reasoned.

Most respondents (64 percent) said the role of their company’s compliance department was to “support another department” in relation to ESG efforts. In an open-ended survey question, respondents repeatedly mentioned “lack of coordination” and “being clear on roles and responsibilities” as considerable challenges to executing on ESG strategy and goals.

The matter of impoverished tone at the top pervaded the survey results, with several compliance professionals explicitly bemoaning lack of leadership support of ESG.

“A lot of firms are getting themselves educated and doing research. So, have they really started (preparing for ESG reporting mandates)? No.”

Mihir Jhaveri, Partner and Risk and Sustainability Practice Leader, Centri Business Consulting

“Leadership doesn’t think this is high enough risk to warrant any time or resources,” one deputy CCO in an unspecified industry remarked. “Executives are not concerned,” echoed a director of compliance in biotechnology.

The grumblings of mid-level compliance practitioners seemed to be borne out by several senior executives in the cohort. One CCO in the securities industry said that while the SEC’s climate-related disclosure proposal would apply to the business, “We do not promote/advertise ESG.” Another CCO in the securities space said that while both the CSRD and the proposed SEC rules would apply to the business, the firm had not begun preparing for ESG-related disclosures.

“We don’t claim to be ESG,” he commented.

How do mid-level practitioners with primary oversight of ESG initiatives help senior executives appreciate the importance of ESG?

“Senior executives like myself—CEOs, [chief financial officers]—always want to focus on those operational and strategic decisions that impact the overall business. So, my advice here would be to approach it that way,” Michlewicz said.

Jhaveri broke it down further.

“Be able to properly articulate the risks as well as the opportunities and return on invested capital,” he said. “What are we missing if we do not integrate ESG into our overall operations and strategy? … Is there a specific revenue stream or target market that the company would miss out on if they were to not get on this journey? Those are the things that the board and management want to hear.”