Podcast

Latest Podcasts

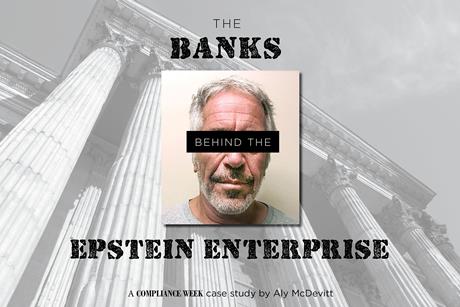

Listen to the radio interview with Compliance Week’s Aly McDevitt on Jeffrey Epstein

Jeffrey Epstein’s finances are back in the spotlight with new reports this month, but Compliance Week published an in-depth investigation into the anti-money laundering compliance angle of the story 18 months ago. Compliance Week’s Aly McDevitt went on WBAI Monday to discuss her investigation

Podcast: BCG managing director on anti-financial crime technology

Staff writer Aaron Nicodemus discussed anti-financial crime technology in banking with Hanjo Seibert, managing director and partner of Boston Consulting Group, during the latest episode of the Compliance Week podcast.

Podcast: SEC Commissioner Hester Peirce on regulatory demands, CCO input

Compliance Week’s Aaron Nicodemus sat down for an exclusive chat with SEC Commissioner Hester Peirce covering the flood of new regulation emanating from the agency, stresses on compliance at smaller firms, CCO liability, and more.

Podcast: Responsible development and implementation of AI

Three experts join the Compliance Week podcast to discuss opportunities and risks posed by artificial intelligence, as well as governance frameworks your organization can implement to ensure AI tools are utilized safely and ethically.

CW National 2024 preview: Former Albemarle CCO on FCPA case lessons

Andrew McBride, former chief risk and compliance officer at chemical company Albemarle Corp., joins the Compliance Week podcast with Aaron Nicodemus to preview his session at CW’s National Conference in Washington, D.C.

Latest News

FTC puts GM’s puts connected vehicle data practices under compliance spotlight

CFPB, DOJ withdraw guidance to lenders considering borrowers’ immigration status

FTC’s $60 million Instacart case puts misleading fees in the spotlight

CFPB humility pledge reshapes exam process, as agency faces uncertain future

SEC exam priorities for 2026 signal heightened focus on firmwide compliance

Costco sues federal government over Trump-era tariffs, seeks refund rights

FDIC eases leverage rules for banks, citing lower risk burdens

Digital Transformation of Compliance

- Previous

- Next

Emotional Intelligence with Penny Mallory

- Previous

- Next

Top Minds: Benchmark Your Training

Vanessa Rossi on operationalized compliance done right

Vanessa Rossi, senior compliance counsel at Baker Hughes, explains to columnist Tom Fox the benefits of operationalized compliance and how to ensure it is properly in place.

Katie Smith on compliance at a growth company

Katie Smith, chief compliance officer at Convercent, shares with columnist Tom Fox the challenges she’s faced as a CCO at a growth company.

Kathy Self on achieving global compliance

Kathy Self, chief compliance officer and data protection officer at Universal Weather and Aviation, explains to columnist Tom Fox the hurdles a small, global company must overcome when approaching compliance.

Kim Yapchai on engaging compliance training

Kim Yapchai, chief ethics and compliance officer at Tenneco, explains to columnist Tom Fox her approach of using interactive games in compliance training.

Marianne Ibrahim on conducting a third party audit

Marianne Ibrahim, director of global compliance at Baker Hughes, offers several best practices for the auditing of third parties.

Cédric Dubar on tone at the middle

Cédric Dubar, chief compliance & ethics officer at Volvo Car Group, details to columnist Tom Fox how tone at the middle can benefit the leadership structure of a company.

Russ Berland on addressing culture in training

Russ Berland, former chief compliance officer at BearingPoint, details to columnist Tom Fox the success a training video series designed in the vein of “The Office” had in bridging culture gaps at his company.

Timur Khasanov-Batirov on ‘Compliance Man’

International compliance officer Timur Khasanov-Batirov joins Tom Fox to explain the inspiration behind his illustrated series, “Compliance Man,” which is designed to help communicate potentially complex compliance topics in a simple manner.

Louis Sapirman on holistic compliance messaging

In our inaugural episode, former CCO Louis Sapirman chats with Tom Fox about his 360-Degrees of Compliance Communication model, which takes an all-encompassing approach to compliance messaging.

Top Minds: Manage Your Risks

Joseph Agins on compliance fallout from ‘Operation Varsity Blues’

Joseph Agins, institutional compliance officer at Sam Houston State University, explains how the “Varsity Blues” college admissions scandal provided a value proposition for enhancements to compliance at higher education institutions.

Bob Ward on pros of targeted sanctions

Bob Ward, director of trade compliance at Wesco International, explains to columnist Tom Fox the benefits of targeted sanctions and how compliance practitioners can properly respond to such.

Cécilia Fellouse-Guenkel on France’s compliance community

Cécilia Fellouse-Guenkel, executive secretary at Le Cercle de la Compliance in Paris, discusses with columnist Tom Fox how compliance is viewed in France and touches on the country’s new anti-corruption law, Sapin II.

Scott Sullivan on compliance lessons from news

Scott Sullivan, former chief compliance officer at Flowserve, explains to columnist Tom Fox how he incorporated the publicized misdeeds of other companies into his compliance training program.

Rod Hardie on FCPA lessons, navigating foreign risk

Rod Hardie, chief compliance officer at Exterran, discusses with columnist Tom Fox what he learned and experienced as an investigator with Baker Hughes during its FCPA investigation in the early 2000s.

Marcel de Chermont: ‘no person left behind’

Marcel de Chermont, founder and principal of Caledonia Consulting, Inc., discusses with columnist Tom Fox how to tailor a risk-based compliance program to different groups of employees while getting the same message across.

Hilary Wandall on U.S. data privacy priorities

Hilary Wandall, senior vice president, general counsel, and chief data governance officer at TrustArc, explains to columnist Tom Fox why U.S. companies should address data privacy now, regardless of their motivations.

Baker Hughes’ Jay Martin on regional compliance coverage

Jay Martin, the associate general counsel and chief compliance officer at Baker Hughes, discusses the positive effect regionalized compliance coverage has had at the worldwide company.

David Bunker on assessing conflict of interest

David Bunker, the compliance officer at Seattle-based nonprofit Vulcan, explains the process he implemented to better assess threats of conflict of interest while maintaining employee freedom.

Dan Chapman talks FCPA investigations

Former CCO Dan Chapman chats with Tom Fox about how to approach an FCPA investigation and come out stronger after remediation.

Top Minds: Culture, Ethics, CSR & More

Max Roche on grant money management compliance

Max Roche, compliance manager of direct funding at the World Economic Forum, discusses his role in making sure grant money received by the organization is spent in the way intended.

Doug Walter on how a new HQ can drive engagement

Doug Walter, chief compliance officer at Phillips 66, explains to columnist Tom Fox how the energy company’s new headquarters has been a valuable tool for employee engagement and recruiting.

Mary Shirley on traveling in compliance

Mary Shirley, senior director of ethics and compliance at Fresenius Medical Care and a 2019 Top Minds recipient, details to columnist Tom Fox the adjustments she’s made in working in compliance across the globe.

Brian Beeghly on defining ethical leadership

Brian Beeghly, former chief compliance officer at Johnson Controls, explains to columnist Tom Fox the steps taken in designing a leadership model in the wake of an FCPA investigation.

Kate Murtagh on sustainable investment

Kate Murtagh, chief compliance officer at the Harvard Management Company, discusses the university’s three-pronged approach to sustainable investment with columnist Tom Fox.

Alison Taylor on CEO activism, social responsibility

Alison Taylor, managing director at Business for Social Responsibility, discusses with columnist Tom Fox the importance and implications of CEO activism in today’s political environment.

Mary Gentile on values-driven leadership

Mary Gentile, director and creator of Giving Voice to Values, joins columnist Tom Fox to discuss the benefits of a values-driven approach to leadership development.

Ellen Hunt of AARP on compliance at board level

Ellen Hunt, the senior vice president, audit, ethics, and compliance officer at AARP, joins columnist Tom Fox to explain the benefits she feels having a compliance expert on the board of directors at a company provides.

Kristy Grant-Hart talks publishing, women in compliance

Compliance practitioner and author Kristy Grant-Hart chats with Tom Fox about her three books and offers her advice to women of all ages in the compliance field.